The financial crisis of 2008 was partially due to the opaque nature of the data masking underlying risks.

I was the UX lead on a team formed by Moody’s Analytics that was tasked with delivering a platform to provide transparency in securitization source data. The software development initiative was mandated by the 2010 Dodd Frank Act.

What this meant was that I had to quickly understand who the users were (Financial Analysts) and what they needed most (fast access to immense amounts of data).

The base platform would provide a tool that Christian Bale’s character in The Big Short could use to look at the line-by-line level data in any given mortgage backed security.

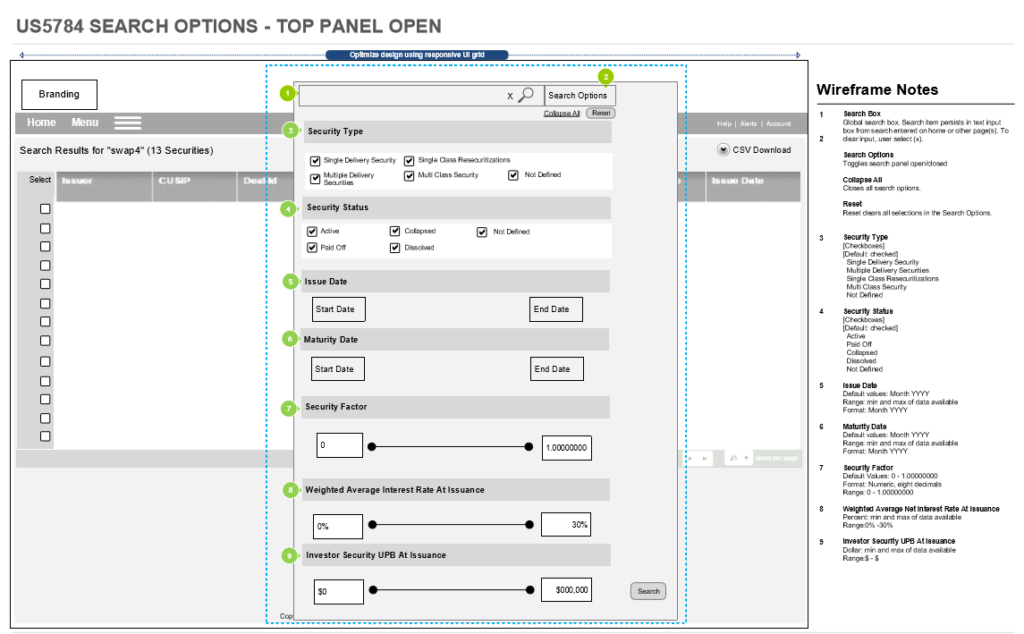

There was a push to make the product responsive which was a step beyond what our primary users needed. The person grabbing the data needed to export it for analysis in another software application.

To add a lot of interactivity to the data tables or focus on mobile wasn’t necessary. The key was to provide users with the ability to search the platform using a number of different filters. That way, they were able to extract details about risk factors and assess whether the financial instrument (usually a mortgage backed security, a bond) aligned with the rating provided by companies like Moody’s and Morningstar.

One of the disconnects in the lead up to the 2008 crash was that ratings didn’t reflect the reality of the underlying bond. The intention for this platform was to mitigate that risk in the future.

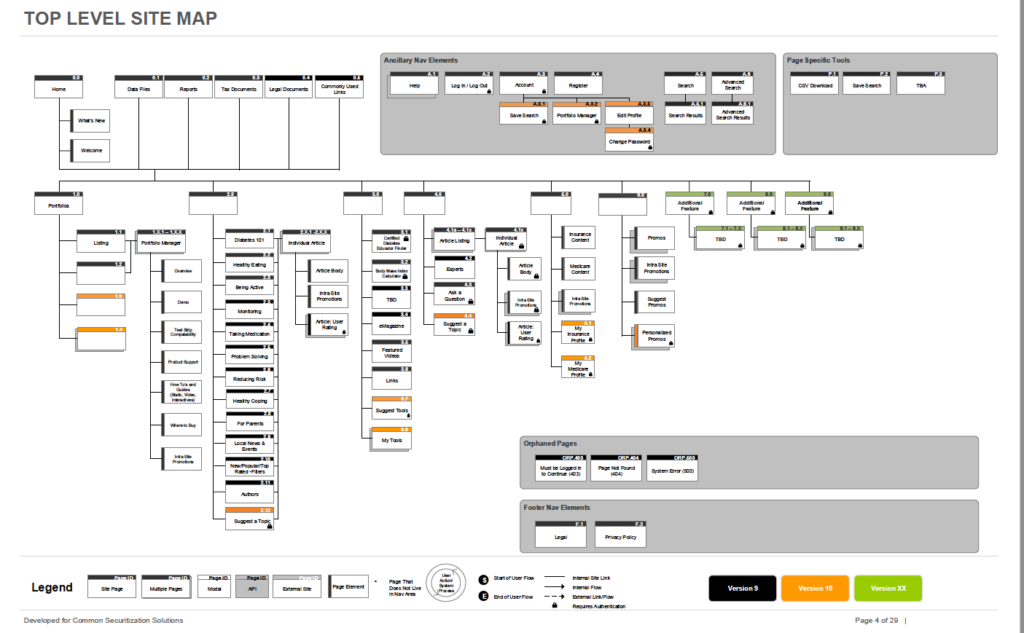

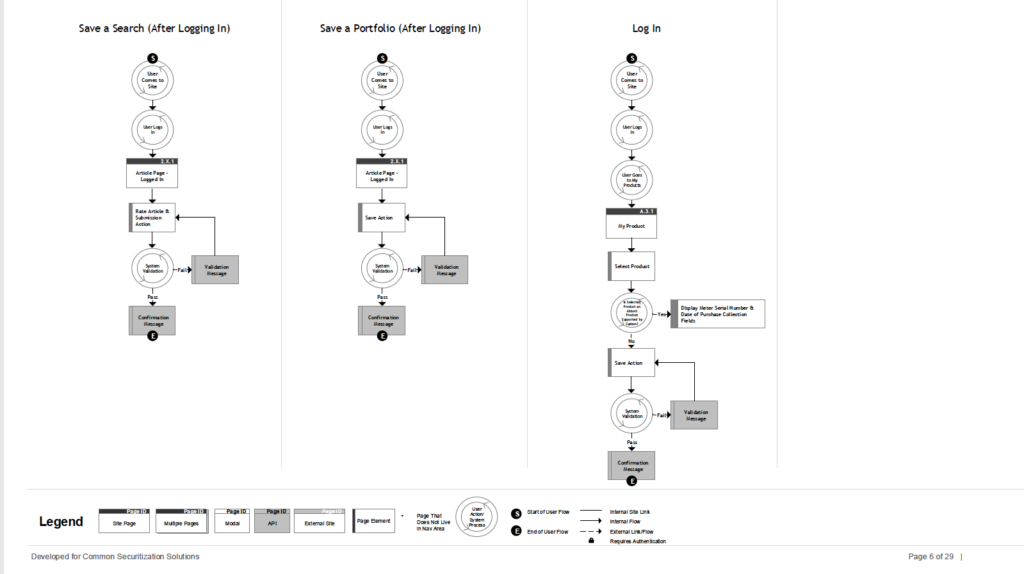

My role included architecting and documenting all details in a comprehensive set of artifacts. The single source of truth for screens, sections, user flows and complex interactions. This process resulted in a set of dev-ready, directional details.

Sample artifacts

This page was created by Larissa Schwartz. No AI was harmed or used in the process. Back to work samples page.